Medical Bills

GOALL PROGRAM

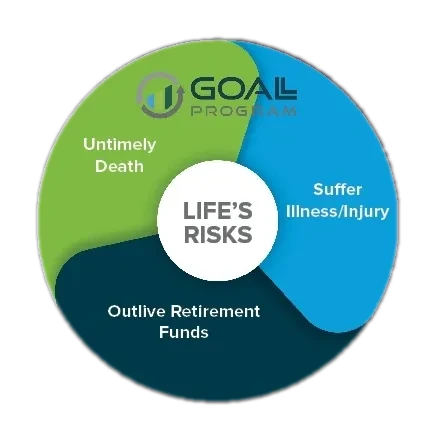

The GOALL (Growth Only Automated Life & Legacy) Program helps US businesses thrive by providing competitive benefits that attract, retain and tether their top talent while protecting them from life’s risks.

The GOALL Program is a cutting-edge benefit opportunity that does more than give you a tax free retirement plan. We provide solutions that protect you and your family from life’s risk; terminal illness, chronic illness , critical illness, critical injury and untimely death. Plus you never lose money when the stock market drops. This is a piece of mind!

Medical Bills

Buying a Home

Paying for College

Retirement

With the GOALL Program, you’ll protect yourself from life’s risks that can cause financial problems during your lifetime!

The program can help people with buying their first home, paying medical bills, and paying for tuition in college as well as creating a retirement fund and more.

However, the retirement fund in the GOALL Program is more beneficial than traditional retirement plans. While traditional plans offer tax-deferred options for growing your funds, plus an employee match, they do not protect employees’ funds if the stock market tanks. Employees do not have access to their retirement funds without having to pay a penalty if they are below the age of 59 1/2.

With these other programs, the likelihood of having your Social Security taxed is very real. There are no compliance fees that need to be paid by the employer with the GOALL Program like other programs. With a typical employer benefit plan, you will not receive the amount of benefits if you get chronically ill, terminally ill, or critically ill or injured as you would receive with the GOALL Program. Typically, benefits like these do not stay with you in retirement, but they do with the GOALL Program.